Let’s Start a Conversation

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.

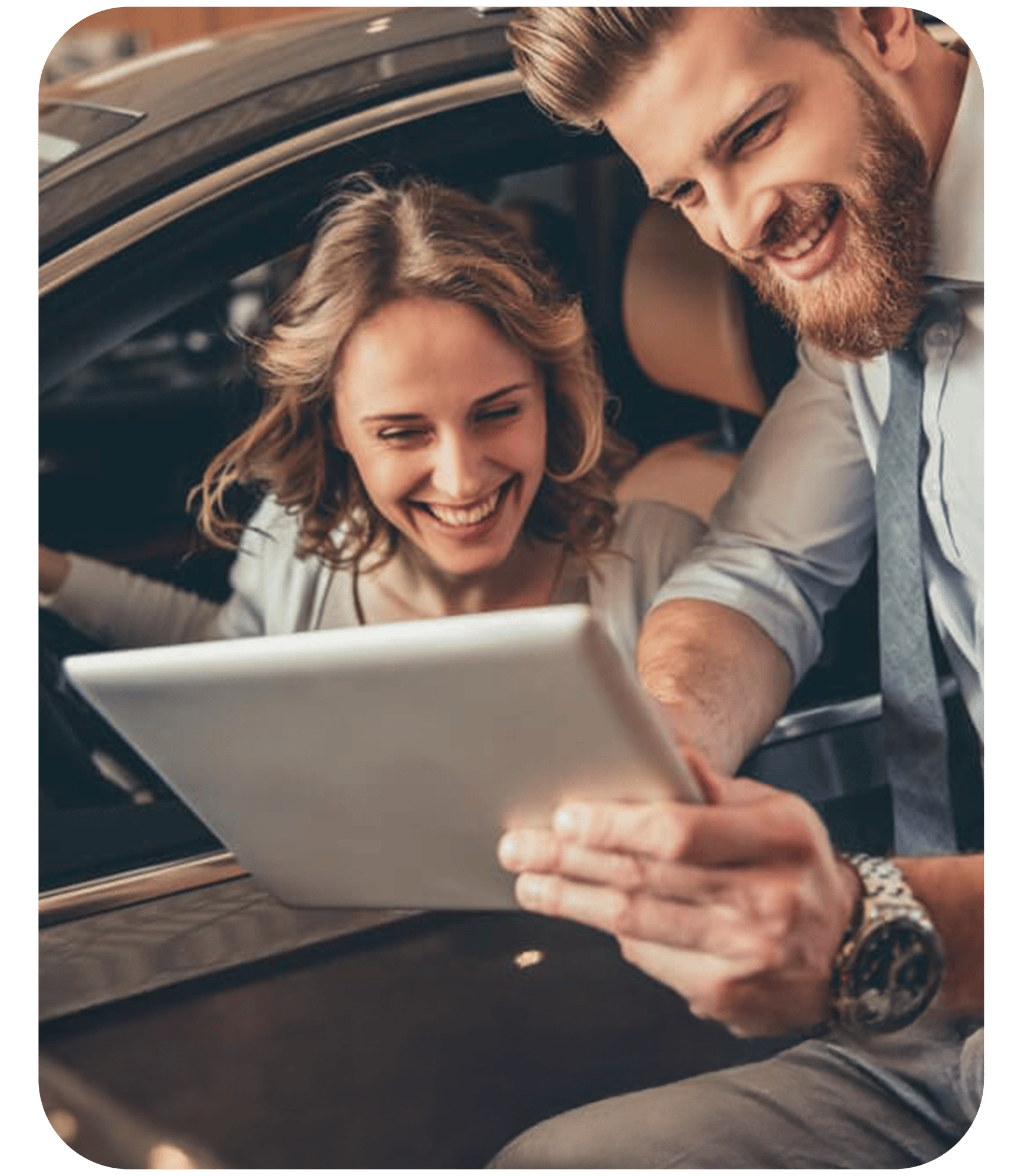

Credin directly addresses the modern customer need for speed and simplicity, delivering a fully digital experience for purchasing, financing, and home delivery of used vehicles.

With Symphony Lending, every step of the process, from application to vehicle handover, is managed seamlessly via web and mobile channels, offering customers a new-generation, end-to-end journey that is fast, secure, and entirely online.

By integrating with over 20 third-party and regulatory organizations, including Turkey’s national authority for banking supervision, every stage, from loan application to vehicle delivery, is managed securely, efficiently, and in full compliance with all legal requirements.

With the successful implementation of this project, Credin became Turkey’s first-ever fully digital consumer finance company, marking a major milestone in the industry.

Here’s what a unified digital platform delivered:

Traditional consumer financing in Turkey was slow, paper-based, and fragmented, requiring in-person visits, extensive manual processes, and complex approvals. Customers and business units faced long wait times, a lack of transparency, and operational inefficiencies, making it difficult to quickly and securely access vehicle financing.

Credin partnered with GTech to launch Turkey’s first fully digital consumer finance platform using Symphony Lending. The new centralized solution enabled seamless online loan applications, instant approvals, and paperless operations, integrating with over 20 regulatory and third-party systems to ensure compliance, security, and end-to-end automation.

By adopting Symphony Lending, Credin achieved a future-ready transformation delivering fast, secure, and scalable financial services powered by digital innovation.

Customers apply and manage credit through mobile and web seamlessly.

From application to approval, every step is optimized and monitored.

Real-time tracking of all forms and reports ensures compliance.

Agile architecture enables rapid rollout of new services and features.

Enhanced speed, accuracy, and accessibility at every touchpoint.

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.