Let’s Start a Conversation

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.

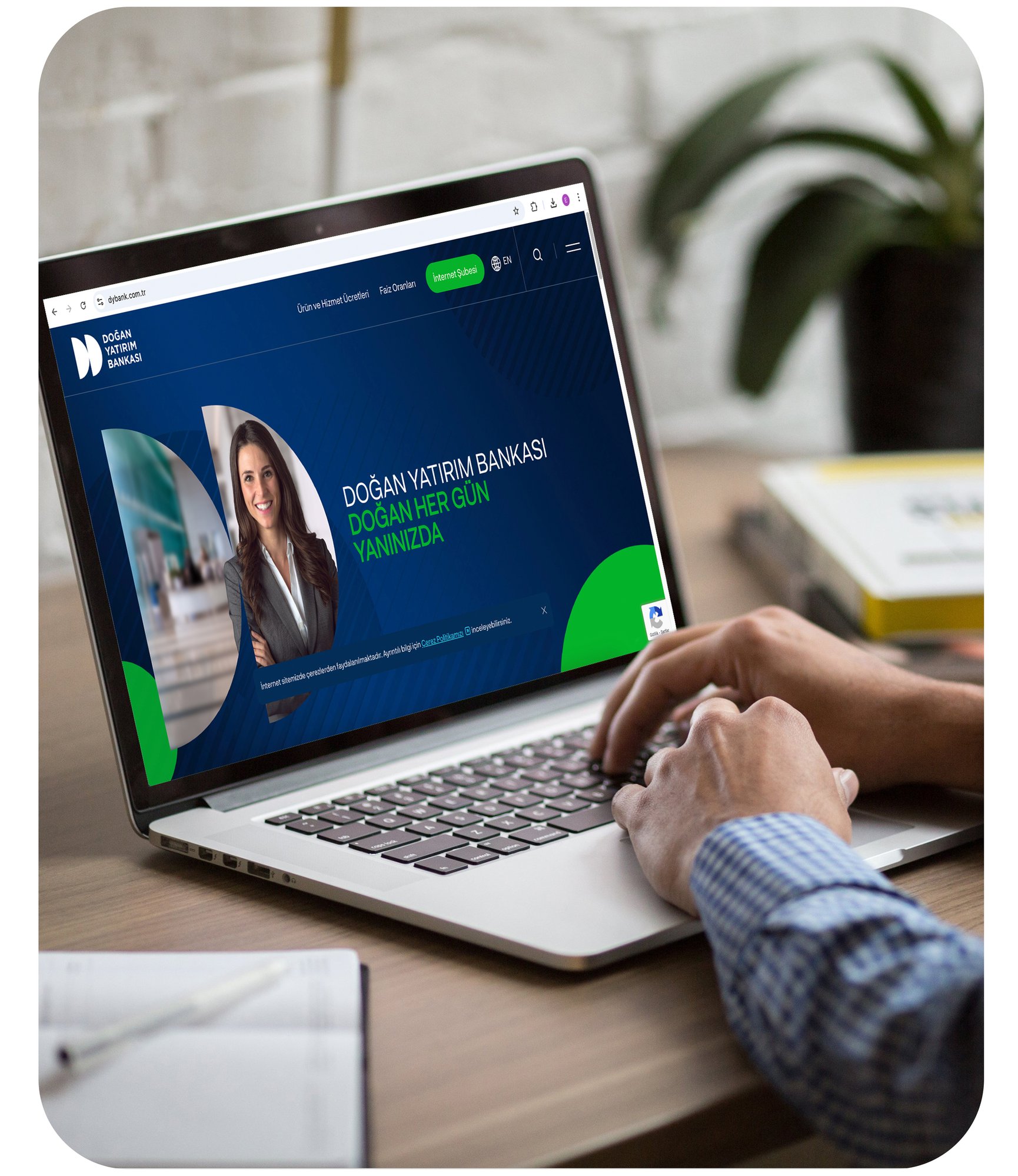

Doğan Yatırım Bank aimed to establish a secure, agile, and modular banking infrastructure to support its business units and future growth strategy.

With GTech’s Symphony Banking platform, the bank successfully centralized its core operations, automated credit and treasury workflows, and achieved BDDK (Banking Regulation and Supervision Agency of Turkey) approval in under 3 months a remarkable milestone for a newly established financial institution.

Built on low operational cost, fast deployment, and seamless integration capabilities, the project enabled Doğan Yatırım Bank to go live with full regulatory readiness and process automation across all critical banking functions.

Doğan Yatırım Bank’s implementation of Symphony Banking redefined operational efficiency and regulatory agility enabling a scalable, data-driven foundation to power growth and innovation.

Here’s what Symphony Banking delivered:

Doğan Yatırım Bank needed to establish an end-to-end core banking infrastructure that could scale with growth, adapt to regulation, and support all critical functions through a single platform.

Doğan Yatırım Bank partnered with GTech to implement an all-in-one digital banking ecosystem centered on Symphony Banking, Magic Reports, and Symphony Analytics.

By leveraging GTech’s Symphony Banking, Doğan Yatırım Bank transformed its operations into a modern, scalable ecosystem empowering every business unit with smart automation, seamless integration, and full compliance.

Lending, treasury, and reporting fully automated.

Real-time insights supported by a unified financial data model.

Every report and form traceable, consistent, and regulation-ready.

Ready for future expansions in products and partnerships.

Reduced risks, improved transparency, and accelerated service delivery.

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.