Let’s Start a Conversation

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.

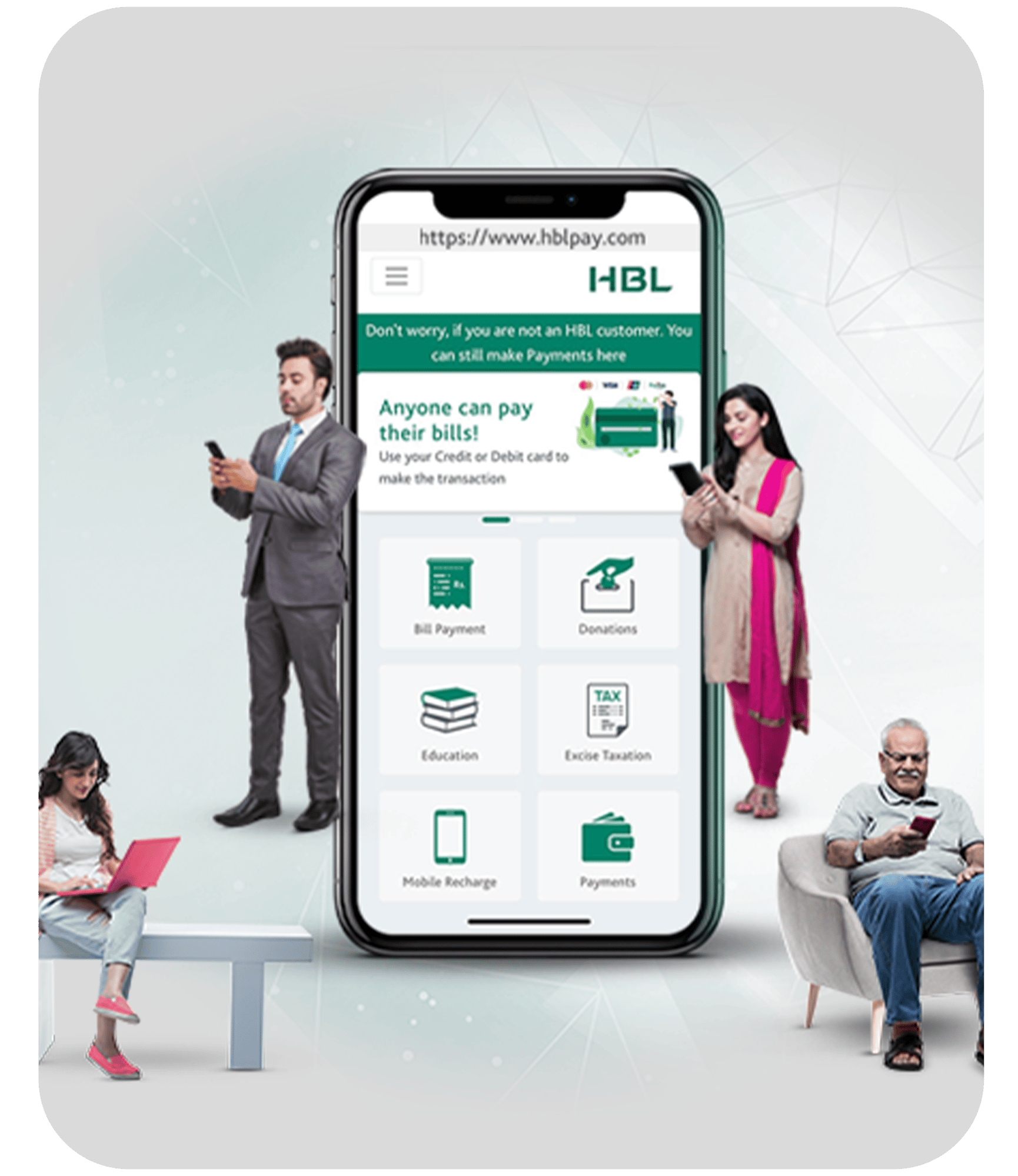

Habib Bank sought to modernize and streamline its core banking operations by transitioning to an integrated infrastructure that would unify all essential banking functions under one platform.

Partnering with GTech, the bank implemented the Symphony Banking solution enabling a more agile, regulation-compliant, and efficiency-driven operating model.

The result? Greater speed, reduced operational risk, and an adaptive business model that meets every regulatory and market need.

Habib Bank’s digital transformation was not just operational it redefined what core banking efficiency and compliance can look like in a rapidly evolving financial landscape.

Here’s what an integrated core banking platform delivered:

Despite its established position in the market, Habib Bank’s legacy systems and fragmented processes created barriers to efficiency and compliance. Manual operations made it challenging to adapt to regulatory updates, ensure data consistency, and quickly launch new products—ultimately impacting service speed and customer satisfaction.

All core banking functions operated on separate systems, increasing operational complexity and overhead.

Account opening and customer onboarding relied on paper-based, manual steps, resulting in delays and errors.

Regulatory forms and legal reports were tracked inconsistently, making compliance audits difficult and less reliable.

Adapting to new market requirements or legal changes required significant time and resources.

Lack of a centralized platform limited agility and the ability to deliver a seamless customer experience.

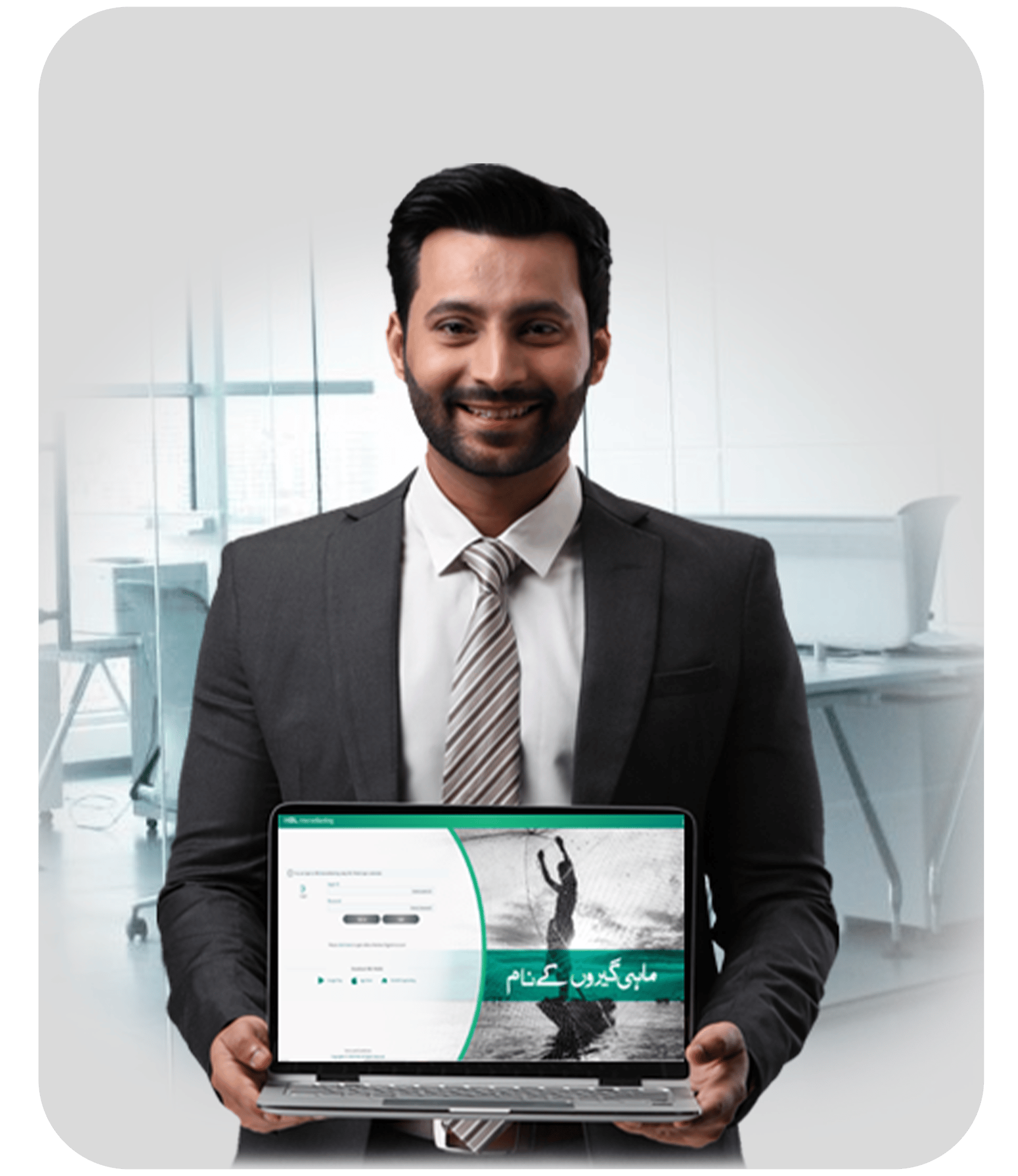

To address these challenges, Habib Bank partnered with GTech to implement Symphony Banking, a centralized, agile core banking platform designed for modern efficiency.

All banking operations were unified on a single, easily adaptable platform, eliminating fragmentation and manual processes.

Digital workflows for account opening, customer onboarding, and regulatory forms replaced paper-based steps, reducing errors and accelerating service delivery.

Real-time legal reporting and electronic scenario-based forms ensured compliance and full auditability.

The system’s dynamic architecture enabled rapid adaptation to new regulations and market requirements.

Centralized monitoring and management allowed quick, cost-effective integration of new products and updates.

With Symphony Banking, Habib Bank now operates on a modern core platform designed for scalability, compliance, and operational efficiency laying the foundation for sustainable growth and superior customer service.

One platform, streamlined operations.

Reduced onboarding times and improved user experience.

Automated monitoring and consistent reporting with tools like TMS and MTF.

Consistent, trustworthy regulatory reporting across the organization.

Less manual work, faster execution, and a future-proof foundation.

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.