Let’s Start a Conversation

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.

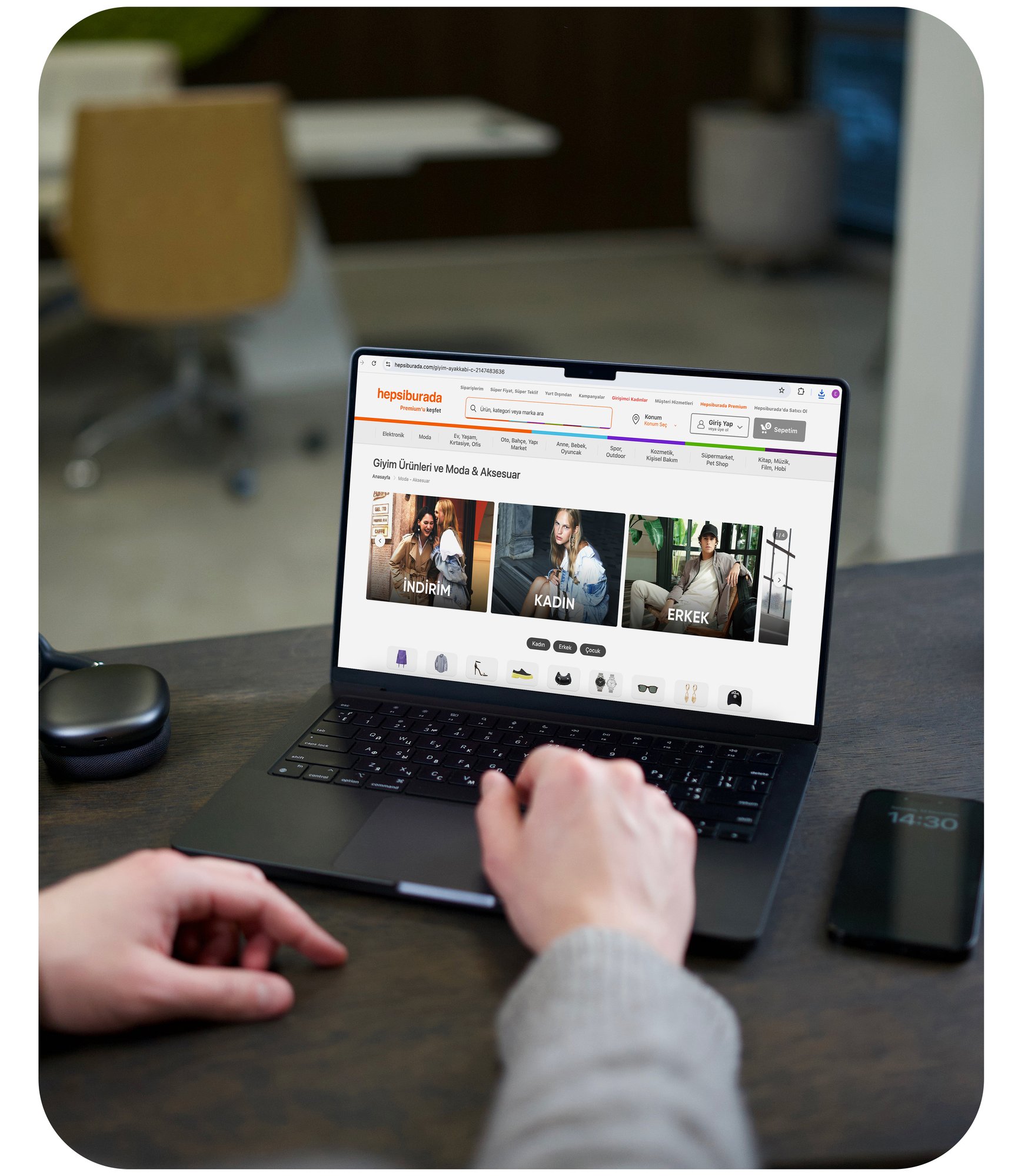

Hepsiburada aimed to enhance its customer financing capabilities by addressing the limitations of traditional e-commerce payment models, such as delayed credit approvals, rigid installment plans, and disconnected user experiences.

In collaboration with GTech, Hepsifinans launched a real-time BNPL (Buy Now, Pay Later) solution designed to deliver instant, flexible credit options seamlessly integrated into the Hepsiburada platform. By combining dynamic product design, end-to-end integration, and robust API architecture, the solution enabled customers to quickly discover their credit limits, complete their purchases, and access personalized financial services all within a single, frictionless journey.

Hepsifinans’s transformation wasn’t just a product launch it redefined how digital financing can empower e-commerce platforms to grow faster, serve better, and operate smarter.

Here’s what real-time, data-driven lending delivers:

Traditional e-commerce credit systems lacked the speed, flexibility, and integration needed to support seamless digital shopping experiences. Customers often faced delays in credit approvals, rigid installment structures, and a lack of transparency in financing options causing drop-offs during checkout and reduced customer satisfaction.

Slow and fragmented credit approval processes limited real-time customer engagement and conversions.

Rigid financing options failed to meet diverse customer needs across a broad online retail ecosystem.

The absence of real-time monitoring and analytics restricted operational agility and strategic insight.

To overcome these challenges, Hepsifinans and GTech collaborated to design and deploy a real-time BNPL solution built on a flexible, API-driven architecture and integrated directly into the Hepsiburada ecosystem.

Developed a real-time lending engine that delivers instant credit limit discovery and approval at checkout.

Built a robust, parametric API infrastructure to streamline integration and accelerate time-to-market.

Enabled flexible payment plan options tailored to individual customer profiles and needs.

Integrated real-time monitoring and analytics tools to ensure transparency, compliance, and performance tracking.

Hepsifinans transformed e-commerce payments with a real-time BNPL solution powered by GTech, delivering faster credit approvals, flexible financing options, and a seamless end-to-end customer experience within Hepsiburada’s ecosystem.

Customers received instant credit limit assessments and approvals at the point of purchase minimizing friction and boosting conversion.

Tailored installment plans matched to individual customer profiles improved accessibility and satisfaction.

A robust and scalable infrastructure enabled seamless integration and faster product rollouts.

End-to-end automation reduced manual processes, increased speed, and ensured regulatory compliance.

Real-time reporting tools supported informed decision-making and operational control.

Over 4 million applications processed in the first year, with a 134% increase in volume and 102% rise in credit utilization driving growth and customer engagement at scale.

Whether you have a specific question or want to explore how we can help transform your data journey, our experts are ready to assist.